Table of Contents

Ready to boost your inventory turnover? Begin with COGS calculator. This indicator comprises all direct manufacturing expenses, including materials and labour, and is critical for optimising pricing and boosting profitability.

Let’s get started and make your inventory work smarter for you!

What is the Cost of Goods Sold (COGS)?

It represents the direct costs involved in producing goods sold by the business. It includes the materials cost, labour involved, and other expenses. It is a pivotal metric as it indicates the company’s production and gross profit efficiency.

How COGS Impacts Business Finances

It significantly impacts the company’s finances and growth, representing overall profitability. A business can be more lucrative if it can cut its COGS by negotiating better deals with suppliers or increasing manufacturing efficiency.

Conversely, an increased COGS can indicate rising manufacturing costs, inefficiencies, or price issues, which may need strategic modifications to preserve financial stability and competitiveness.

In a nutshell, effective monitoring is crucial for sustaining business practices’ long-term growth and sustainability.

The Formula for Calculating COGS

Standard COGS Formula: The standard formula for calculating the cost of goods sold is as follows:

COGS: Opening inventory (+) Purchases (-) Closing inventory

COGS Calculator is crucial for companies as it assists in determining the direct costs associated with the goods sold over a specific time frame.

The opening inventory is the worth of the stock at the start of the period.

All new items acquired during the period are considered purchases. The closing inventory is the stock value left at the period’s end.

ALSO READ: The ROI vs Cost of AMRs

Example of COGS Calculation

For instance, if a company starts the year with an opening inventory valued at ₹50,000, makes purchases totalling ₹1,00,000, and ends the year with a closing inventory valued at ₹30,000, then the cost of goods sold will be

COGS: 50,000+ 1,00,000 – 30, 000 = 1,20,000

Why Accurate COGS Calculator is Crucial?

An accurate COGS calculator is crucial as it enables businesses to determine direct expenses and perform accurate accounting for them, which impacts their financial health.

This accuracy helps to determine the various pricing strategies, manage inventories and identify cost efficiency that can be achieved.

Making Smart Choices: Understanding the expenses of purchasing or producing your items helps you make wiser choices. For instance, if you calculate the COGS and discover it’s higher than your income, you realise you need to explore ways to reduce costs or negotiate more favourable deals with suppliers.

Effect on Profit Margins: The computation of COGS directly influences a company’s profit margins. Gross profit is determined by deducting COGS from total revenue, and it’s crucial to assess the profit before considering other costs.

Role in Financial Reporting and Analysis: Cost of Goods Sold (COGS) is essential in financial statements and evaluation because it is a critical factor in the income statement. The accurate reporting of COGS is vital for determining a company’s profitability, and this clarity is essential for investors, stakeholders, lenders, and the management team when reviewing these financial documents.

Furthermore, it guarantees that financial statements are transparent and trustworthy by following accounting standards and laws.

Strategically Pricing Your Products: The details help you determine the desired profit margin and can offer valuable insights into establishing product pricing and cost control.

What are the Benefits of Using a COGS Calculator?

Accuracy: A COGS calculator can help you calculate precise production costs and expenses and perform effective inventory management.

Efficiency: Using the COGS calculator helps to save time and effort and maximise results with the help of automated solutions.

Informed Decision Making: Precise calculations and cost breakdowns can help businesses implement effective pricing strategies and efficient cost control strategies.

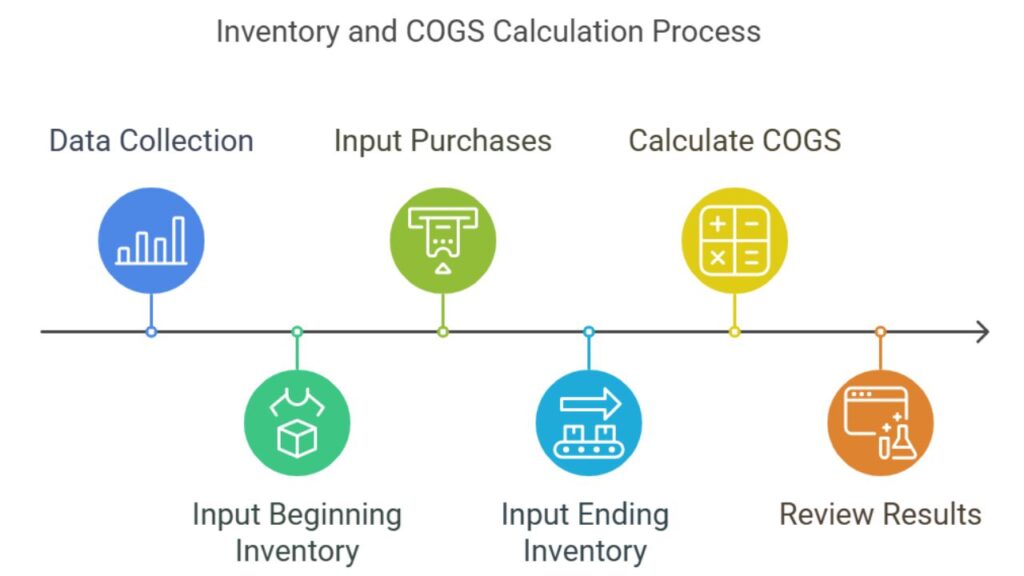

Step-by-Step Guide to Using the COGS Calculator

- Data Collection: Collect inventory data at each cycle’s start, purchase, and finish.

- Input Beginning Inventory: Enter the value of your inventory at the start of the period.

- Input Purchases: Determine the total cost of the inventory acquired during the period.

- Input Ending Inventory: Enter your value at the end of each period.

- Calculate COGS: To determine the cost of goods sold, click the ‘Calculate’ button.

- Review Results: Examine the COGS value returned by the calculator for accuracy and insights.

What are the Strategies to Maximise Inventory Turnover?

- Efficient Inventory Management: Using streamlined systems for tracking and managing inventory optimises stock levels, eliminating surplus inventory and lowering storage expenses.

- Just-In-Time (JIT) items System: Using a JIT system allows organisations to order items only when needed, lowering stock holdings and increasing inventory turnover rates.

- Regular inventory audits: It helps detect slow-moving or obsolete items, allowing for prompt modifications and improved inventory control. This ensures that inventory levels are appropriate for current demand.

Wrapping Up

Our innovative inventory management solutions automate and optimise inventory control with real-time updates and thorough analytics. By utilising these new technologies, businesses may increase inventory turnover and lower expenses.

A COGS calculator is required to maximise inventory turnover. The COGS calculator assists businesses in precisely calculating their cost of goods sold, allowing them to make innovative pricing, purchasing, and inventory management decisions.

FAQ

What is COGS?

COGS refers to the direct costs of producing goods a company sells, including materials, labor, and manufacturing overhead.

Why is COGS important?

It helps determine gross profit, guides pricing, and aids in managing expenses.

How does a COGS calculator help?

It automates cost computations, reduces errors, and provides insights for better financial planning.

What’s included in COGS?

COGS includes direct materials, direct labor, and manufacturing overhead, but excludes indirect expenses like distribution.

Is it useful for all businesses?

Yes, especially for those in manufacturing or selling products, to determine accurate production costs.

How does accurate COGS impact financials?

It ensures true profitability in financial reports by affecting gross profit calculations.

Founded in 2016, Addverb offers complete robotics solutions for warehouse and industrial automation, with a strong global presence through its subsidiaries worldwide. The company provides a range of in-house automation products, including Autonomous Mobile Robots, ASRS, and sorting technologies. It serves over 350+ clients, including well-known companies such as Coca-Cola, Amazon, and DHL.